- Yaro on AI and Tech Trends

- Posts

- 🫧The AI Bubble Conundrum.

🫧The AI Bubble Conundrum.

Plus: Claude 3.5 becomes the Best AI Model.

Get in Front of 50k Tech Leaders: Grow With Us

Happy Friday, Team!

Exciting news to kick off the weekend: Anthropic has just unveiled the most powerful LLM yet—truly a milestone in AI! Additionally, we’ve prepared a tutorial on financial management using AI and shared our insights on the AI Bubble Conundrum. Looking worfard to reading your comment and opinions, please share them. Enjoy!!!

📰 News and Trends.

Debt Repayment Planning using AI.

Claude 3.5 becomes the Best AI Model.

🧰 AI Tools of The Day (Financial Mgmt)

The AI Bubble Conundrum.

📰 AI News and Trends

YouTube is going to start cracking down on AI clones of musicians with a tool to allow musicians to take down deepfakes of themselves (TheVerge)

AI-Scripted Movie Premiere Canceled (TheGuardian)

Apple, Microsoft Shrink AI Models to Improve Them “Small language models” emerge as an alternative to gargantuan AI options (IEEE)

Ilya Sutskever, the AI legend who helped attract the best talent to OpenAI, has finally revealed his next endeavor — a startup focused on creating an AI system more intelligent than humans with safety as its top priority (SSI)

🌐 Other Tech news

Biden bans US sales of Kaspersky software over Russia ties (Reuters)

SpaceX is rolling out a compact version of its Starlink antennas, a mobile option for its satellite internet customers, priced at $599 (CNBC)

New York Governor signed two bills into law that aim to protect kids and teens from social media harms, making it the latest state to take action as federal proposals still await votes (TheVerge)

How Apple is winning the financial services game (Axios)

TikTok is quietly releasing a new Instagram competitor called Whee… but it’s not in the US yet (TubeFilter)

Debt Repayment Planning

Using Claude, ChatGPT, or any other AI model for debt repayment planning involves a blend of conversational AI capabilities and your own financial management efforts. While these aren’t directly integrated with financial databases or real-time budget tracking tools, some (chatGPT and Gemini) can be linked to your spreadsheets via Google and Microsoft Drive. Either way they can assist in formulating a strategy, explaining debt management concepts, and simulating repayment scenarios based on hypothetical data.

Here’s how you can effectively use them for this purpose:

1. Understanding Debt Repayment Strategies.

Ask your AI: Request explanations of different debt repayment strategies like the snowball and avalanche methods. For instance, you could ask, "Can you explain the debt avalanche method?"

They can provide detailed explanations and examples, helping you understand which strategy might suit your financial situation best.

2. Simulating Debt Repayment Scenarios.

Provide Hypothetical Data: You can give hypothetical or anonymized data about your debts, such as interest rates, balances, and minimum payments.

Ask for a Simulation: Request a basic simulation of debt repayment. For example, "If I focus on paying an extra $200 towards the highest interest rate debt each month, how will that affect my overall interest paid and time to debt freedom?"

Note: Remember, ChatGPT doesn't process real-time data or personal information securely; ensure that all data shared is hypothetical or sufficiently anonymized.

3. Creating a Custom Debt Repayment Plan

Plan Drafting: Ask AI to help outline a debt repayment plan based on the strategies you’ve learned. For instance, "Help me draft a debt repayment plan using the snowball method."

Interactive Tweaking: You can refine the plan interactively, tweaking amounts, timelines, or priorities based on your financial preferences and capabilities.

4. Learning About Debt Management Tools

Tool Recommendations: Ask for recommendations on AI tools and apps that can automate or assist with debt management. We have a tools section at the bottom of this newsletter.

5. Financial Education

In-depth Learning: Use AI to deepen your understanding of related financial topics like interest rates, the impact of credit scores on borrowing costs, and ways to avoid incurring additional debt.

Practical Tips: Ask for practical tips on budgeting, saving, and other financial best practices that can indirectly support your debt repayment plan.

Example Chat

Your Prompt: "What’s the difference between the snowball and avalanche debt repayment methods?"

AI: "The snowball method involves paying off your smallest debts first before moving on to larger ones, which can motivate you by quickly checking off smaller debts. The avalanche method, on the other hand, focuses on paying debts with the highest interest rates first, potentially saving you more money on interest over time."

By using ChatGPT in these ways, you can gain a better understanding of debt management strategies, create a preliminary plan, and learn about tools that can automate and enhance your debt repayment efforts. However, for actual financial transactions and personal data handling, it's recommended to use secure, specialized financial tools and consult with financial professionals.

Learn how to become an “Intelligent Investor.”

Warren Buffett says great investors read 8 hours per day. What if you only have 5 minutes a day? Then, read Value Investor Daily.

Every week, it covers:

Value stock ideas - today’s biggest value opportunities 📈

Principles of investing - timeless lessons from top value investors 💰

Investing resources - investor tools and hidden gems 🔎

You’ll save time and energy and become a smarter investor in just minutes daily–free! 👇

Claude 3.5 is the Best AI Model

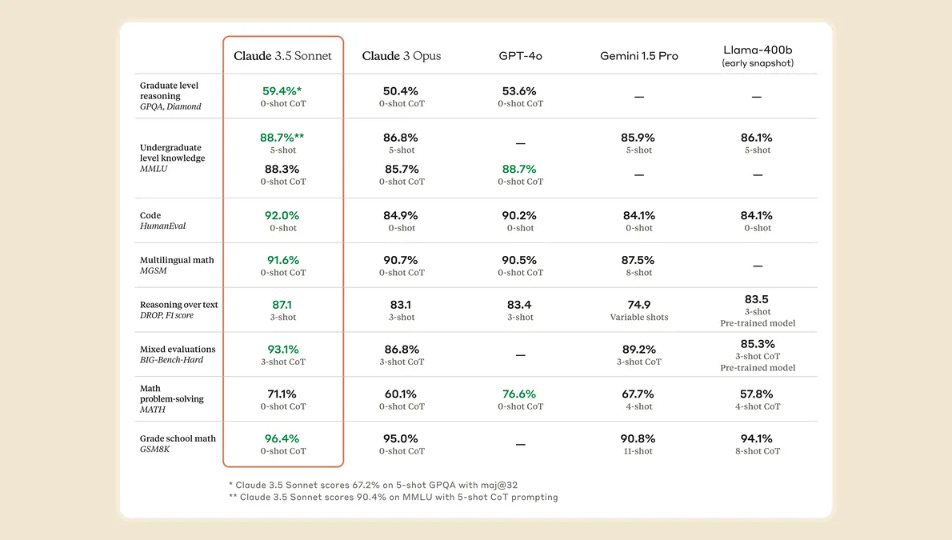

Benchmark Scores

Anthropic has introduced its latest AI model, Claude 3.5 Sonnet, positioning it above their previous models and claiming it surpasses OpenAI's GPT-4o and Google's Gemini in various benchmarks. This new model, available for both web and iOS users, is notable for being faster and more efficient, with significant improvements in handling complex tasks like code writing, multi-step workflows, and text interpretation from images. Additionally, Anthropic has launched a feature called Artifacts, enhancing interaction with AI-generated content by allowing users to see and modify outputs directly within the app. This move signals Anthropic's broader ambition to evolve beyond basic chatbot functionalities and develop a comprehensive tool for business applications, aiming to centralize company knowledge and workflows in a single platform.

The AI Bubble Conundrum.

The current state of AI investments and the potential for a bubble in the industry are highlighted in recent discussions and analyses. A significant gap of $600 billion exists between AI infrastructure investments and actual revenues, with a substantial revenue shortfall in the broader AI market. Many industry insiders believe we're in an AI bubble, drawing parallels to the early internet era, while acknowledging that bubbles can drive innovation despite potential failures. There's a sense of urgency in the industry, with companies racing to be first-to-market with groundbreaking AI advancements. Potential slowdown factors include plateaus in AI capabilities or failure to translate them into economic value.

All the research we did led us to the importance of creating lasting value for end users rather than chasing short-term profits, something that Apple seems to be doing well. Historical parallels are drawn to previous tech booms, noting that truly transformative applications often take time to emerge. While there's agreement on AI's long-term potential, questions remain about the shape of progress and how quickly economic value will be realized. The overall perspective emphasizes the current excitement and massive investments in AI, while also highlighting the need for caution, realistic expectations, and patience as the industry evolves.

🧰 AI Tools Of The Day.

Apps for Financial Management - Today’s AI tools section complements our tutorial of the day.

1. Personalized Budgeting and Expense Tracking: Mint, YNAB (You Need A Budget), PocketGuard.

3. Investment Guidance: Betterment, Wealthfront, Acorns.

4. Credit Education and Improvement: Credit Karma, Experian, MyFICO.

8. Personalized Financial Advice: Personal Capital, Albert.

9. Goal Setting and Tracking: Goals in Google Sheets with AI, Twine.

10. Language Accessibility: Google Translate, Microsoft Translator.

Download over 500+ Tools free here.

Newsletter Recommendation:

Growth Forum - Learn how to build a repeatable sales process creating a pipeline full of qualified deals.

Secrets of Success - Learn Mental Models for success.

Reply